Analyzing the Numbers for Different Office 365 Workloads

Office 365 Keeps Growing

With the active user count for Office 365 now at 155 million, thoughts turn to how many people use each of the major workloads. Microsoft doesn’t give this information, but hints emerge in articles and conference sessions as clues for what the situation might be. Add a healthy dose of informed guesswork and we can come up with some figures.

The major Office 365 workloads are:

- Exchange Online.

- SharePoint Online (including OneDrive for Business).

- Teams.

- Yammer.

- Planner.

The 155 million number for Office 365 covers paid subscribers. Office 365 supports many unpaid users too (including Microsoft’s own tenant, many development tenants, partners and others), so the comparison offered here is based on paid subscribers.

Exchange Online

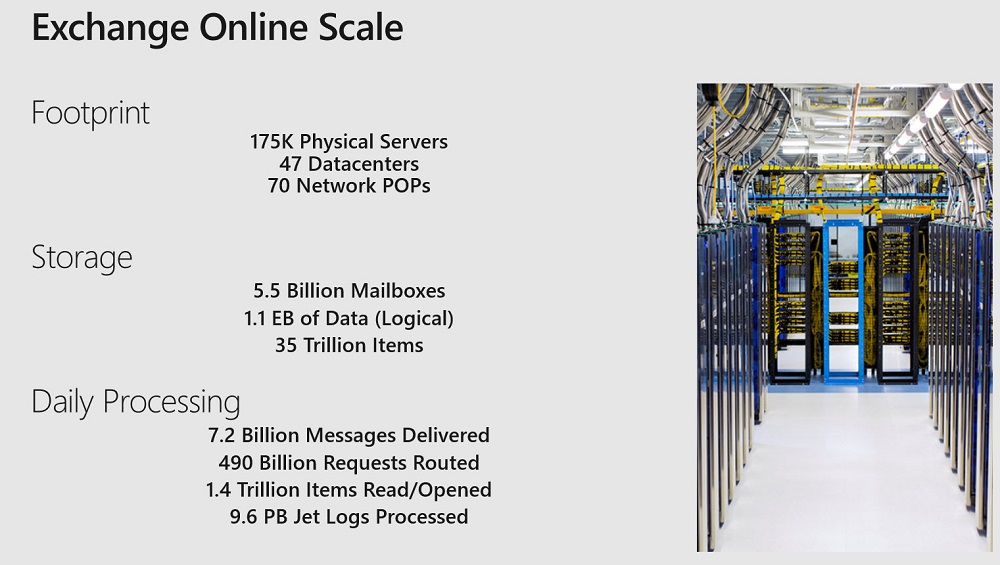

Email was the first workload to move en masse to the cloud and it still is the single biggest workload in the cloud. Statistics released by Microsoft at Ignite 2018 revealed the massive scale of the Exchange Online infrastructure (Figure 1).

Over its 22-year history, Microsoft has never revealed the size of the Exchange installed base. Competitive reasons always kept mouths closed. Industry analysts such as the Radicati Group tracked mailbox growth over the years and the consensus reached by analysts was that more than 300 million Exchange seats were sold. Perhaps some of these were licensed and never used, but there’s enough wiggle room in the guesswork figures to say that the Exchange installed base is very large.

Based on the enthusiastic interest in the forthcoming Exchange 2019 release at Ignite 2018, there’s still life in Exchange on-premises, but comments from Microsoft at the same event indicate that the majority of mailboxes are now cloud-based. Given the pervasive use of email, it’s likely that almost every active Office 365 user has an Exchange Online mailbox and makes Exchange the largest cloud workload.

SharePoint Online

SharePoint is harder to call. Again, Microsoft doesn’t give formal numbers out, so we rely on comments from Microsoft spokespeople over time. Often, these comments focus on the total number of SharePoint users (on-premises and the cloud) and the percentage in the cloud. Table 1 references comments made at conferences, in press coverage, and in Twitter to give us a rudimentary timeline.

| Date | Number of claimed SharePoint Users | Percentage in the cloud |

| October 2009 | 100+ million | Zero |

| March 2011 | SharePoint adding 20,000 users/day (7.3 million/year) | Zero |

| November 2015 | 160 million (paid seats) | 40% |

| August 2016 | 190 million | |

| April 2017 | “More than 200 million” (Jeff Teper tweet to Brad Sams) in more than 200,000 organizations. | |

| September 2017 | More than 300,000 organizations | 65% |

| May 2018 | More than 400,000 organizations (speech at SharePoint Virtual Summit) | 70% |

Table 1: Timeline for SharePoint numbers

Microsoft claimed 200 million for overall SharePoint seats in April 2017 and then said in September 2017 that growth in active users increased 90% over the last year. At that point, Microsoft said that 65% of SharePoint seats were online, which causes some math problems. 65% of 200 million is 130 million, which is more than Microsoft claimed for the total Office 365 active user count at the time. The 70% claimed in May 2018 equates to 140 million, also over the 135 million Office 365 claimed then, so there’s some inconsistency in the SharePoint numbers. One way to explain the discrepancy is if the number used for SharePoint Online is based on those who have a license and differs from those who are active.

Microsoft doesn’t talk about the number of OneDrive for Business users, but I suspect that this is close to the overall total of Office 365 users. Not using OneDrive for Business if you have an Office 365 account seems shortsighted, especially now that Files on Demand is coming for the Mac and the OneDrive synchronization client is so much better than it was in the past.

Don’t get me wrong. I think there is terrific growth in SharePoint usage within Office 365 that is being driven by the adoption of Teams and Office 365 Groups, both of which make SharePoint document storage easier for users to consume. Even if the number is not quite as high as the marketing propaganda claims, SharePoint Online is easily the second largest workload inside Office 365.

Teams

Microsoft gave some interesting information about Teams at Ignite 2018, revealing that over 329,000 organizations now use Teams, with over 60 customers having more than 10,000 users and the largest (Accenture) with 108,000. Doing some quick calculations based on assuming that an average of 100 people per organization use Teams, its total user base might approach 33 million (6 million of which is accounted for by 60 organizations).

We need more data to track Teams more accurately. What’s clear though is that its availability to Office 365 tenants (including the U.S. government cloud), rapid evolution, and tight integration with the rest of Office 365 is driving growth.

Yammer

A year after Microsoft bought Yammer in 2012, they reported that Yammer users approached 8 million. That was the high point for Yammer. Microsoft had no other collaboration offerings within Office 365 and the full might of Microsoft’s marketing organization was behind the new enterprise social network. Another year on, cracks had started to emerge, and some commentators said that Yammer’s lack of integration with the rest of Office 365 created a barrier to adoption. Two years later, the lack of integration was still evident.

Move forward to 2018, a new general manager and a new strategy gives new hope to the long-suffering Yammer base. Despite some recent changes, the comments by GM Murali Sitaram at Ignite where the stated aspiration is to move Yammer to tens of millions of users leads me to believe that its usage still is stuck at under ten million.

Planner

It’s hard to know how many people use Planner because Microsoft has given few if any clues on this topic. Its integration with Teams and the new SharePoint web part gives Planner new routes to increase usage, but Planner seems to be squeezed by To-Do at one end and Project on the other. Maybe that’s why no one talks about its user base or the number of companies that use Planner.

Summarizing the Numbers

The truth is that no one outside a limited circle inside Microsoft knows the true numbers. All we can do is guess. With that in mind, Table 2 captures my best guess for the numbers using the different Office 365 workloads.

| Number active users (paid seats) | Number cloud users (including free seats) | |

| Exchange Online | 135 – 150 million | 180 million |

| SharePoint Online | 110 – 130 million | 140 million |

| Teams | 25 – 30 million | 35 million |

| Yammer | 5 – 8 million | 9 million |

| Planner | 3 million | 3 million |

Table 2: Summarizing User Numbers for Office 365 workloads

I cheerfully accept that I could be wrong. In fact, I probably am for at least some of the numbers. But that’s OK, because the purpose of the exercise is to show that there are two massive workloads inside Office 365, one that’s coming up fast, and others that are much smaller. I think that’s an accurate statement.