Is Poor Product Distribution Hurting Microsoft?

As a person that works in the distribution business, I was amazed when I saw Microsoft’s strategy for selling products such as Windows Azure or Surface. Microsoft is effectively trying to sell product directly to customers, something that they have only ever had a tiny sliver of experience at doing. That became very clear when every channel that carried Surface 2 ran out of stock in the lead up to the 2013 Christmas holidays. If your product is selling, then how can you not carry enough produce to continue momentum? It happened again when Microsoft ran out of Surface Power Cover stock. In this article I will introduce you to the world of distribution, explain how one of Microsoft’s competitors gets it right, and then talk about what Microsoft does or doesn’t do in product distribution.

What Is Distribution?

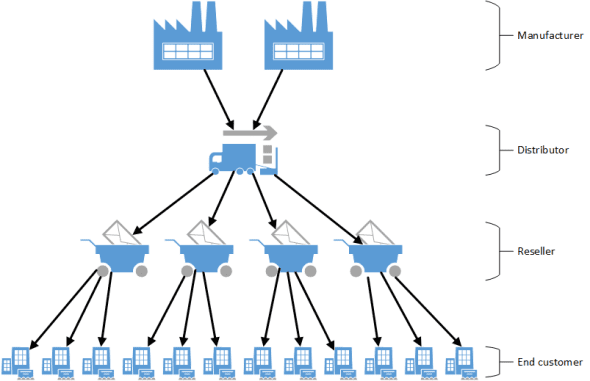

Most consumers of product are completely unaware of the role of distribution in the channel. The role of a distributor is to:

- Purchase stock from numerous distributors:

- Sell stock to resellers (who we call customers) at a tiny margin. These can be retail chains, single shops, consulting companies, and so on.

- The reseller adds a margin to the stock and sells it to the final consumer (who we call end customers). This can be your grandmother buying a tablet or a mid-size business buying Office 365 on a Microsoft Open licensing agreement.

Why wouldn’t the manufacturer bypass the channel and sell directly to the end customer? Think about this: What do Samsung or General Electric appliances know about retail? The answer is very little, and they do not want to. Their core business is to design, manufacture, and market product. They offload the distribution and retail side of the business to the channel. That allows the manufacturer to focus on what they do best, and the channel can give the manufacturer access to what we call a breadth market.

And that is exactly what distribution offers. Typically, the very large retail chains (think Walmart in USA, Metro AG in Germany, DSG in the UK) do not buy from distribution. Instead these chains will buy direct from the manufacturer. This allows the manufacturer to have access to a very large pool of end customers via a small team of account managers. But there is still a wider audience that does not purchase from the chain; they either prefer to buy from smaller operators or have no choice. Manufacturers cannot afford to dedicate resources to these smaller pockets of customers. Distribution provides a channel that allows manufacturers can tap into that can open up the breadth market.

We can return to the world of Microsoft to show an example of this. Microsoft has account managers that will deal directly with large customers and managed partners. An account manager might have a few or even only one of these “EPG” customers to sell to. Large enterprise or government customers offer huge rewards for concentrated effort. Microsoft’s resellers are services companies that are referred to as partners. There is a technical and sales competency system in the Microsoft partner program. Partners that reach certain levels of competency through technical/sales/licensing exams, sell significant amounts of Microsoft product, and are doing things of interest to Microsoft can become managed partners. This is when an account manager is assigned to the partner and a team of people will assist that partner. Once again, a small team of people are working with a small group of high-reward organizations.

But there are many smaller partners and end customers out there that Microsoft never or rarely deals directly with. It’s a huge market, but Microsoft cannot afford to interact with them the same way that they do with larger organizations. Distributors work closely with Microsoft to market to, train, and assist those other partners. This is what I do in my day job. My colleagues are licensing experts and I have to time to develop and share technical and solution knowledge.

The benefit to Microsoft is that distributors are dealing with huge numbers of resellers in the retail and commercial markets. Those resellers are coming to the distributors to get stock for software and hardware from multiple manufacturers. This gives the distributor a much larger reach than Microsoft can afford to maintain. And with this reach, a value added distributor (VAD) can assist Microsoft in marketing, selling, and educating about products and services on behalf of Microsoft.

Additional Benefits of Distribution

Apple is a hardware manufacturer that makes very good use of their distribution network. They really don’t need any assistance in marketing their product or attracting resellers. Instead, Apple is using distributors for their expertise in logistics:

- What stock is there in the channel?

- Where is it?

- Where is it is needed?

But most importantly: How much stock of each product is needed in the future? Every Apple distributor must gather “pipe” (referring to sales that are coming down the pipe) numbers from authorized resellers. This data is fed back up to Apple, and they can use these future sales estimates to manage manufacturing. Maybe more iPad2s are required (they are still sold as the cheaper full-sized tablet from Apple). Maybe the 32 GB cellular version of the iPad Air was over-manufactured. Or maybe the MacBook Air Retina is going to be popular and much more stock must be shipped from China to avoid lost sales.

Distribution of Microsoft Cloud Services

Microsoft has a long established and very successful history in selling OEM and Volume License software into the channel via distribution. I have seen, locally and internationally, how Microsoft subsidiaries partner with distributors not just to increase breadth, but also to take advantage of skills or headcounts that Microsoft cannot raise internally.

However, the fragmented managed of Microsoft’s cloud services has an interesting history. The first of these was Business Productivity Online Suite (BPOS) which became Office 365 (O365). Originally, O365 was only available to buy directly from Microsoft. This was a superb way to make the channel (distributors and partners) not care about the success or failure of Microsoft’s strategic play against Google Apps. One could even argue that many partners felt threatened by O365 and were cheering for it to fail. Then in 2012, Microsoft announced that “in the near future” O365 would be sold through distribution. Partners would be able to resell O365 to their customers and maintain that billing relationship. It was like someone flicked a switch; O365 became the hot new product, and now it is rare (at least here in Ireland) to find a partner that is not selling this cloud service.

Microsoft does not have a cloud services division. O365 lives in one division. Windows Azure is elsewhere. Windows Intune is somewhere else. Windows Intune has – how do I say this politely? – it has been about as popular with partners as a rat carrying the plague. I like the service. Microsoft made so many mistakes with Intune when it launched:

- The pricing and packaging was wrong: It was at least twice the price of the competition.

- Wrong direction: Windows Intune was pitched as a managed services product for partners. Competing products were more mature, designed for purpose, were cheaper, and already deeply embedded in the market.

- Sold directly by Microsoft: There was nothing to interest distributors in promoting Windows Intune and partners saw it as another threat.

- The audience was lost: Even after Microsoft fixed the issues, the partners had already stopped paying attention.

Microsoft fixed the pricing and packaging of Windows Intune over a year ago to make it very competitive. They have developed hybrid/remote device and BYO solutions that make Windows Intune a unique offering in the market. And Windows Intune will be available through distribution (allowing partners to resell it) in April 2014. One has to ask: Why did it take so long?

The elephant in the room is now Windows Azure. You can purchase services from Azure via an Enterprise Agreement (a massive up-front commitment to credit on the service) or pay-as-you-go with a credit card. Unlike Windows Intune, there are a set of partners who are intrigued by the possibilities of Windows Azure. But I am convinced that Windows Azure must follow Windows Intune and O365 into the channel to gain critical mass.

The Surface Flop

It’s no secret that Microsoft’s tablet, Surface, has been a mess. There was a $900 million write-down in 2013 of the first-generation stock. Microsoft refuses to comment on how many Surface units have been sold; however, they have no problem telling us how much business SharePoint, Office, Windows, and other successful products have shipped.

The problems started on day one. Microsoft limited sales of Surface to the United States. This is a strategy that I like to call “The Curse of Zune,” remembering the walking dead MP3 player that Microsoft only shipped to its home country (the other 6.7 billion people on the planet couldn’t even browse the Zune website). It boggles my mind why Microsoft would limit their market to just 0.04 percent of the global market. Slowly, Surface appeared in a few other larger countries but in very limited numbers and only via the Microsoft Store website.

I remember touring a number of large retail outlets on the east coast of Ireland the day Windows 8 was made generally available. I chatted with a number of salespeople. Time and time again I heard one question “Do you have the Surface in stock?” The answer was always “no” and then the staff member would have to admit that they had no idea when Microsoft’s tablet would be on the shelves. It ended up being a long time, and in just a few large resellers.

Distribution had no role in shipping Surface in those early days. In 2013, Microsoft started to ship through a few global distributors. I guess Microsoft had no interest in the breadth market or in identifying what sales were “in the pipe.” The latter was inconceivable to me; anyone who works closely with Microsoft on software talks so much about “the pipe” that they could be confused with drainage engineers or crack addicts.

Microsoft was burned by their overproduction of version 1 stock (it sold for just $99 for the 64 GB version at TechEd and WPC conferences). It appears (and we have no evidence of this) that they cut their manufacturing orders for Surface 2, but without any from-the-field sales estimates. The worst possible thing that could happen actually happened.

Surface 2 was in demand. How much demand we will never know because Microsoft won’t release the numbers. But we know that across the world, Surface was sold out in December 2013. This is about the worst time of year to run dry on consumer products. The market needs product, and you cannot supply it, they’ll find an alternative. One must wonder how many lost sales there were for Surface 2 in that holiday season.

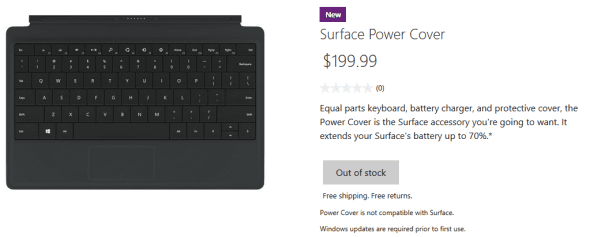

One would think that lessons would be learned, but alas. I guess someone is making the same mistakes that U.S. intelligence services did in the late 1990s. They’re focusing on spreadsheets and computer models rather than putting feet on the ground (resellers and distributors) and getting real information (“the pipe”). The docking station for Surface Pro shipped, stocks ran dry very quickly, and no one knows when there will be more. More recently, the much-anticipated powered keyboard cover for Surface went on sale and supplies ran out in two days. Customers are browsing to the Microsoft Store, and aren’t able to give Microsoft money for this product.

Microsoft’s most popular Surface variant appears to be the Surface Pro. I find this funny, because Microsoft has done everything possible to choke sales to businesses. Someone, somewhere, drank the Gartner Kool-Aid and thinks that every business user buys their own device for work. BYO is interesting, but it is a niche strategy, just like VDI (more Gartner Kool-Aid) was niche before it. The vast majority of business users get their devices from the business, and the business buys devices from resellers. With no distribution, resellers cannot buy Surface for their customers. Instead, they’ll buy tablets from HP, Dell, Toshiba, or even Apple, add a small margin, and ship them to their customers. Microsoft launches a site to allow resellers to order Surface online, but this is a complete farce. This is not how the channel works and how business is done. When I see all the mistakes of how Surface has been sold I start to wonder if Microsoft really wants the tablet to fail!

Distribution Works and Benefits Microsoft

Microsoft’s distribution account managers (and I work with a great one) know how to make the most of their channel partners. They have a long history of working with distributors in hardware and software sales, and more recently, distributors have proven that they can bring those same skills to help promoting and selling cloud services (O365) that had previously underperformed. Microsoft’s attempts to go it alone have failed every time. Most of Microsoft knows that their strength is their channel and their partners (resellers). “A PC on every desk” was only made possible by selling to the breadth market. I hope that the “one Microsoft” realizes that their best tools are not being used, and starts to use them properly. Maybe then the months of “out of stock” messages will end, and customers will find product that they want in the places that they want to find them.